Intuit Link is an online portal for you to connect and share tax documents to complete your tax return. No more bulky tax packets or piles of paper. Now you can deliver your information simply and securely on line.

Click here to sign in to Intuit Link.

Dive into the tools and tips that’ll guide you every step of the way.

Need more info? Scroll down for troubleshooting help or explore the links below for handy PDF guides. Get started and navigate your tax journey with confidence!

Table of Contents:

- Access Intuit Link

- Understand Intuit Link

- Share Info with Accountant

- How to change the email address you use for Intuit Link

- How to upload documents to your tax preparer

- Get my W-2

- Get my forms

- Get it from Google Drive

- From a desktop computer: Browse to upload a document your computer

- From a mobile device: Take a picture or Upload documents

- Bulk uploading taxpayer documents

- Troubleshooting uploading documents

- How can I reset my password if I forgot it?

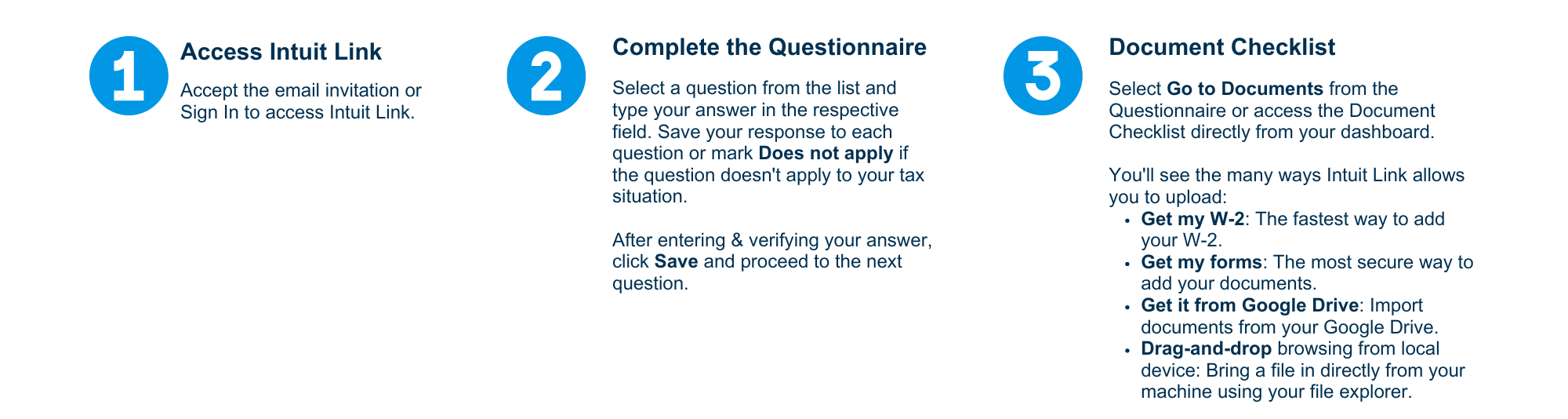

Access Intuit Link

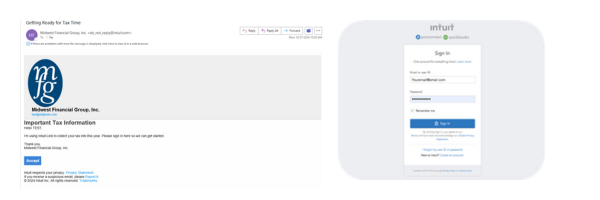

To begin, open the invitation email from your accountant. ACCEPT invitation or SIGN IN to access Intuit Link. (Quick Tip: Your sign in email and invitation email should be the same.)

New users: If this is your first-time using Intuit Link SIGN UP using the SAME email address from your invitation.

Returning users: If you have used Intuit Link before or have an existing Intuit account SIGN IN (do not sign up) with your existing credentials.

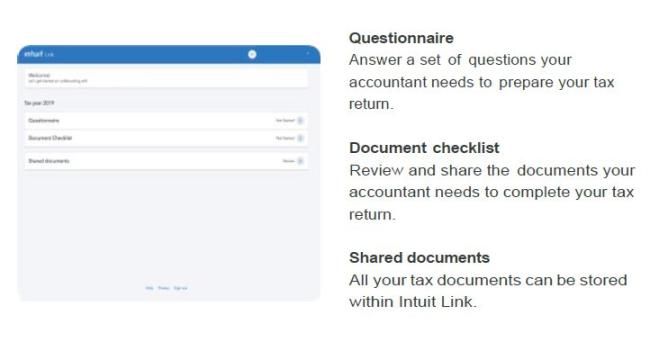

Understand your Intuit Link

Intuit Link is home to all your requests for key information related to your upcoming tax return including your engagement letter, questionnaire, document checklist and shared documents.

Share Info With Accountant

First step, complete the questionnaire: Select a question from the list and type your answer in the respective field. Save your response to each question or mark Does not apply if the question doesn't apply to your tax situation.

Select Comments to leave a note and Post to share it with your accountant (optional). Continue this for each question listed and Submit to send responses to your accountant.

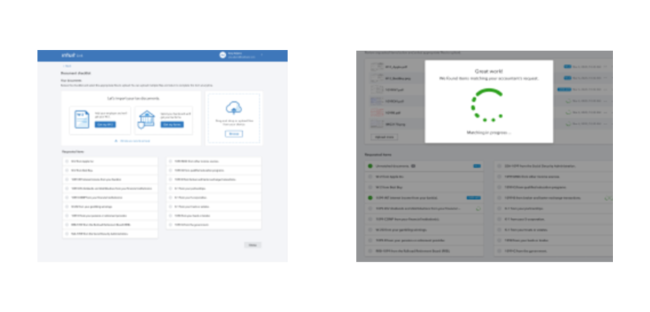

Final step, share your documents.

Add to your employer and financial institutions to securely pull in your tax forms and quickly share them with your accountant. You can also drag and drop them into the dotted area or Browse to upload files from your device.

Viola, Intuit Link will match selected files to your Document checklist and notify your accountant as your documents are matched. Great job, your work here is done.

How to change the email address you use for Intuit Link:

If you have not accepted the invite contact your preparer to issue a new invite under the correct email.

You should not change the username as that is what ties the accountant/taxpayer relationship, only the email address should be changed.

If your Link invitation has been sent to the incorrect email and you accepted it, you can change the notification email to receive emails on your preferred email by completing the following steps:

- Log into Intuit Account Manager with the email address that was invited to Intuit Link.

- Select Sign in & Security.

- Click on your email address to edit it

- Change the Email address to the correct one and enter the new email in Confirm email address.

- Click Save.

The next time you login you will still use the incorrect email, but any notifications or password resets will be sent to your correct email.

How to upload documents to your tax preparer:

You can upload documents from your computer, phone or tablet or download documents from your Financial Institutions and Payroll Provider. To upload your documents:

- Sign in to Intuit Link

- Select the Document Checklist.

- Select how you want to send your document.

- Click Share a document

There are 4 ways to share documents with your Preparer (Please Note: Intuit cannot access documents without taxpayer permission.) :

Get my W-2:

W-2 from your Payroll Provider:

ADP

Intuit Payroll Services

- Click on the To Do tab.

- Locate the W-2 Request item and press Add A Document.

- Click Get it for me.

- Enter the employers EIN and then click Continue.

- Enter the SSN, Box D control number, and Box 1 amount. Then click Get my W-2.

- Click Done.

Get my forms (Maximize size of a file that can be uploaded to Link is 30 MB):

1099-INT, 1099-DIV, 1099-R, 1099-Misc, 1099-B, or 1098 from your financial institution

- Once you have clicked Get it for me

- Type the name of the bank or investment account in the search field.

- Enter your login credentials for your financial institution. This will be the same user ID and password you use to login to your bank or investment account.

- Intuit Link will detect the document you are wanting to download and any related documents.

- Select how you want to connect to your financial institution the next time you connect.

- Select Connect automatically with this login information if you would like the web browser to save you login id and password.

- Select Do not connect automatically, I have multiple logins or Never connect automatically if you do not want the web browser to save your login information.

- To download the document(s) to Link, click Done. Click the trash can icon next to the documents you do not want to download.

- The documents will now be visible in Link.

Get it from Google Drive

- Select Get it from Google Drive.

- Sign in to your Google Drive Account.

- If prompted to allow access, choose yes.

- Browse to the documents, once selected press Select to upload it.

From a desktop computer: Browse to upload a document your computer

- To upload a document that is saved to the computer, select the Browse button.

- Browse to folder where the document is saved, select the document, and click Open.

To upload multiple documents in response to one question from the accountant, hold down the crtl key on your keyboard and click the files that need to be uploaded. Then click Open. Alternatively, you can upload one file at a time to a single question by clicking the paper clip, selecting one document to upload, and then repeating this process multiple times.

- Select Done.

From a mobile device: Take a picture or Upload documents

Intuit Link makes it easy to send documents to your Preparer. You can upload documents by taking a picture directly from your phone.

The Take Photo option is only available when logging in using a mobile device such as a smartphone or tablet. There is no app to download.

Snap photo of a document and upload to the Tax Payer Link portal:

- Open the browser on a mobile device and go to https://prolink.intuit.com

- Sign in.

- Enter your user ID and password to login.

- Select Document Checklist.

- Select the document name you need to upload, then Share a document.

- Under Take a photo or upload documents from your phone select Upload documents.

- Select Take Photo or Video.

- Using your mobile devices camera take the photo, then select Done.

Bulk uploading taxpayer documents

- On the Documents screen, click the Browse button.

- In the next window, search for and select the files you'd like to upload.

Windows: To select multiple files on that are adjacent, use the Shift key and select the first and last file at the end of the entire range you wish select. Alternatively, to select multiple files not within a defined range, hold down the Ctrl key as you click on each file until all are selected.

Mac: To select multiple files that are adjacent, use the Shift key and select the first and last file at the end of the entire range you wish select. Alternatively, to select multiple files not within a defined range, hold down the Command key as you click on each file until all are selected.

- Once all desired files are selected, click Choose.

- Select the Done button at the bottom of the Upload Progress window once the button presents itself.

- Once the files are uploaded, the tool will then match the files with any source documents your tax preparer requested. Any uploads the tool was unable to match will be bucketed as Unmatched Documents, which may later be assigned a document type by the tax preparer.

Troubleshooting uploading documents

If you encounter problems uploading documents such as continuous spinning wheel or an error occurs while uploading documents, clear the browsers cache and try the operation again.

Down below you will find links to instructions on how to clear cache/cookies for our supported browsers:

Google Chrome

Mozilla Firefox

Microsoft Edge

How can I reset my password if I forgot it?

If you have forgotten your password, you can reset it by:

- Go to Intuit Account Manager

- Enter your email if prompted

- instead of entering password, select Sign in a different way

- Select to get a code via Text or Email

- Enter your code to sign in

- Once in the Intuit Account Overview page, select Sign in & security

- Select Password

- Enter your new password